Can I deduct unreimbursed employee expenses?

The Tax Cut and Jobs Act made many sweeping changes to the U.S. tax system. One of the biggest changes under this new law was the elimination of the deduction unreimbursed employee business expenses beginning with 2018 tax returns. This effectively means that employees will no longer be able to offset their taxable income by common business expenses they may incur.

It is important to note that this change under the TCJA does not have an effect on the expenses that non-wage earning self-employed individuals (e.g., those individual filing Schedule C or Schedule F) are allowed to claim to offset their income subject to the self-employment tax.

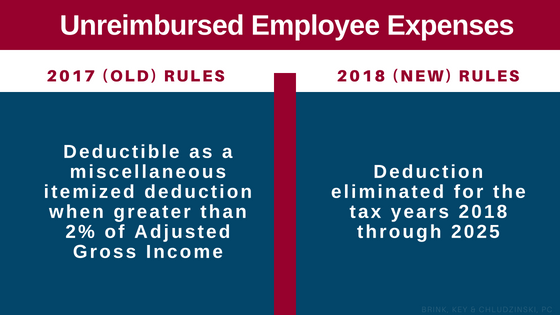

Prior to 2018, employees were allowed to claim deductions for their unreimbursed business expenses as itemized deductions on their tax return. This allowed employees to reduce their tax liability on account of having several common business deductions, including travel, supplies and many other items. Under these older rules, an employee’s deduction for their unreimbursed employee business expenses could only be claimed if they itemized their deductions (as opposed to claiming the standard deduction), and was only allowed to the extent the total of these expenses exceeded 2% of their adjusted gross income (AGI). The Tax Cut and Jobs Act not only eliminated this deduction for employee business expenses but also eliminated all other miscellaneous itemized deductions subject to the 2% floor.

The elimination of the deduction for employee business expenses under the TCJA is not permanent, as the deduction will be reinstated beginning in 2026.